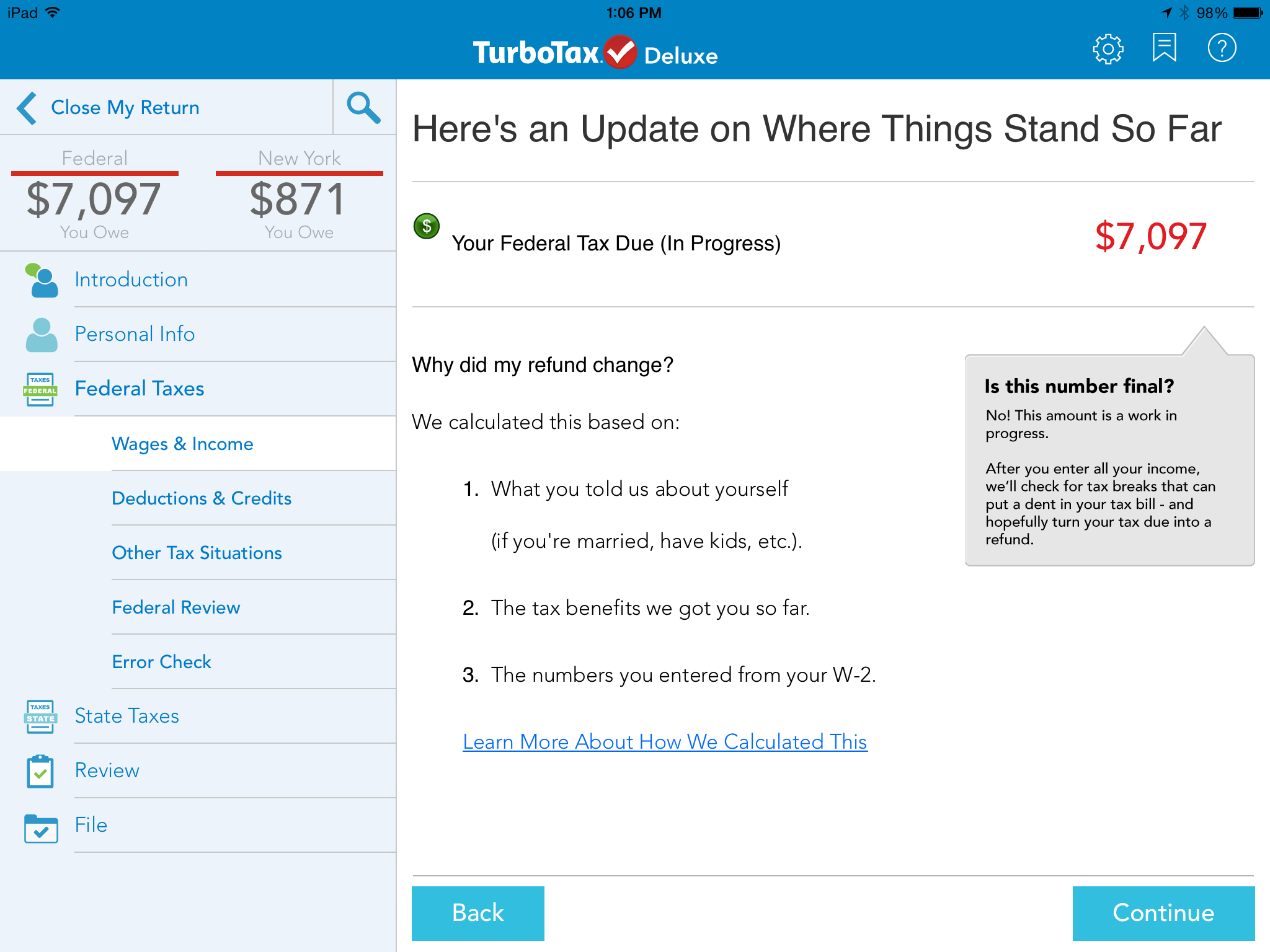

Investment companies, banks, universities, and even mortgage lenders offer customers online portals to access year-end financial data. Many employers provide employees online access to their paystubs. Generally, the last paystub received in 2014 will show your yearly wages and withholdings. Online “Do It Yourself” tax software companies, such as TurboTax, offer free online tax calculators to help you estimate your possible refund or tax due. In other words, you will not have to pay a late payment penalty for not paying the health insurance penalty before April 15 th. Thankfully, the late payment penalty does not apply to the penalty for not having minimum essential healthcare insurance. This year, taxpayers who did not have medical insurance the entire year and did not qualify for any of the healthcare exemptions may owe additional tax in the form of a Shared Responsibility Payment. And, since life never stands still, you probably encountered a few changes last year that could affect your taxes as well. Keep in mind, however, that even an income increase of a few hundred dollars can tip the scales and cause a refund to turn into tax due.

If you received a federal refund on your 2013 tax return and your total income, deductions and withholding remained relatively the same during 2014, chances are you may not owe taxes on your 2014 return. But what if you have no idea what you earned last year? What if your tax documents were misrouted to Antiqua and, instead of having them mailed back, you are saving to retrieve them personally? Thankfully, there are a couple of options available to help determine if you should send a little change the IRS’s way with your extension. Generally, extensions give taxpayers additional time to file, not to pay the taxes due. If you think you owe tax to the IRS, you should pay it by April 15 th to avoid a late payment penalty.

The form is considered timely filed if postmarked by April 15th. You can also download, print, fill-out and mail Form 4868 from the IRS website. Extensions can be e-filed free of charge at the TurboTax website. An extension gives you until October 15th to file your return.

As long as you pay what you owe and file the extension by April 15 th, you should escape the taxing boogie man and his late-filing penalty.įor federal purposes, extensions are filed on Form 4868. Well, good news! The IRS has a snooze button they call an “Extension.” An extension allows taxpayers to gently glide into the world of taxes by providing more time to recuperate from the recent year gone by. After all, you never did get those W-2s, your mortgage interest statements, or that student loan paper showing the obnoxious amount of student loan interest you paid in 2014.

0 kommentar(er)

0 kommentar(er)